How to buy USDT in India

Are you hoping to ride the crypto wave? Need information on how to buy Tether (USDT) in India? You’ve hit pay dirt! We’ll help you by sharing all the information we have on how to buy USDT in India.

It’s no wonder that crypto enthusiasts turn to USDT or Tether, a stablecoin. USDT strives to maintain a nearly constant value, in contrast to volatile cryptocurrencies like Bitcoin and Ethereum.

In spite of the fact that Tether’s price may fluctuate occasionally, the vast majority of its owners aren’t holding it for the sake of profit. A stablecoin’s strength lies in maintaining its value rather than appreciating in value, as the ‘stable’ in its name suggests.

What is a stablecoin?

News involving cryptocurrencies almost always talk about the extreme price swings that occur. Tether, however, has a fixed value because it is pegged to the dollar.

Stablecoins such as Tether are able to keep their value stable because they are backed by a collateral pool. There is a term used in the cryptocurrency industry to describe USDT, and that term is “collateralized stablecoin.”

Stablecoins are a fantastic alternative to traditional cryptocurrencies for those with a lower tolerance for risk who wish to diversify their holdings and profit from the crypto market.

About Tether Crypto

Tether (USDT) was the first stablecoin and is still the most popular. Tether Limited is a platform that releases blockchain-based assets pegged to the value of fiat currency.

Tether (USDT), the most widely used stablecoin, was originally released in July 2014 under the name Realcoin. It is a second-layer digital token that was constructed atop Bitcoin’s blockchain using the Omni platform.

To put it simply, USDT’s value is proportional to that of the US dollar. To ensure that the token’s value is fixed relative to the US dollar, an amount of US dollars equivalent to the total number of USDT in circulation must be kept in reserve in the form of commercial paper, deposits, cash, reserve repo notes, and treasury bills.

They wanted to make a token on Ethereum whose value is fixed at $1 per token at all times, so they pegged it to the US dollar. Every USDT token can be exchanged for one dollar in U.S. currency from a reserve maintained by Tether Limited.

Fun fact: There is a mystery surrounding Tether Limited’s reserve funds: nobody knows how much they are!

History of Tether (USDT)

Brock Pierce, an established entrepreneur with a track record of success in the cryptocurrency and entertainment industries, created USDT, often known as Tether.

Reeve Collins was a co-founder of USDT and several other successful businesses, including the online advertising network Traffic Marketplace, the entertainment studio RedLever, and the gaming website Pala Interactive.

For the first two years, he also served as Tether’s CEO. They weren’t the only ones involved in the Tether project; Omni Foundation member Craig Sellars has been there for almost six years.

How Tether works

It’s no secret that the cryptocurrency market is quite unstable. This means that the value of a cryptocurrency may experience significant swings throughout the day. USDT, on the other hand, is safe from these swings.

That’s because Tether promises that USDT will always be worth the same as one U.S. dollar. Tether puts the same number of US dollars into its reserves for every new USDT token it creates. Thus, USDT is completely supported by cash and other liquid assets.

Tether has the important feature of always being worth 1 USD. Because of the unpredictability of the cryptocurrency market, this distinguishing attribute alone gives it a significant advantage over competing stablecoins.

Tether is the most widely used stablecoin, and it stands out from the competition in that it can be used with different blockchains. Omni, Ethereum, Tron, EOS, Liquid, Algorand, SLP, and Solana all support USDT, and you can buy them with Bitcoin right now.

Reasons to Buy Tether (USDT)

By being exchangeable for US dollars, USDT is a strong asset. It’s a helpful tool for avoiding the wild price swings that can occur in the bitcoin market. By exchanging the value to USDT, for example, you greatly lessen your vulnerability to sharp declines in the value of your cryptocurrencies.

There are no transaction costs or time delays while purchasing tether, unlike with conventional assets. Tether’s efficiency as a cryptocurrency and its reliability as a store of value make it a fantastic asset. To sum up:

- It’s worth $63 billion, making it the fifth largest company in the world by market cap.

- It can be used in many different shops, both online and off.

- Facilitates international transactions.

- How long a tether transaction takes is variable depending on the cryptocurrency being utilized.

- It is backed by cash reserves and so cannot be “mined.”

Where can you buy Tether?

Tether is a cryptocurrency that is widely available for purchase on the best cryptocurrency markets. There are several places where you may trade Indian Rupees for Tether, and here are a few of them:

- CoinDCX

- WazirX

- ZebPay

Using these markets, you may quickly and easily trade your Tether for Bitcoin (BTC), Ethereum (ETH), and a wide variety of other cryptocurrencies.

Let’s say you’re interested in diversifying your Tether holdings by combining them with those of other cryptocurrencies. That makes it simple to implement. Tether may be traded for other cryptocurrencies on the vast majority of centralized and decentralized exchanges.

Even though Tether is a stablecoin tethered to the U.S. dollar and therefore doesn’t “pair” with other cryptocurrencies, it is nonetheless widely used to make cryptocurrency purchases.

In October 2021, Kaiko, a distributor of digital assets, discovered that Tether was used in the execution of approximately half of all Bitcoin trades.

Things to consider before buying Tether (USDT)

Before you rush off to buy Tether, pause and consider:

- Tether, in contrast to most cryptocurrencies, is considered to be fiat money and can therefore be used as a payment method.

- One tether is currently worth $1, so there is no need to fret over price fluctuations.

- USDT coins issued by Tether are infinite in number. Over 63 billion coins have been minted as of this writing.

How to buy Tether (USDT) in India

Watch our detailed video tutorial for a better understanding of how to buy USDT in India:

Create an Account

Verify Account

Buy USDT

What can you purchase with Tether?

In terms of daily volume, Tether tokens are among the most traded tokens, making them extremely liquid.

Tether tokens provide an efficient substitute for fiat gateways in a wide variety of contexts, including cryptocurrency exchanges, digital wallet apps, decentralized finance (DeFi) protocols, and payment systems.

While cryptocurrencies can’t be used as legal cash anywhere yet, some retailers like watch and vehicle dealers do accept them.

You can also use Tether on online casinos and betting platforms like UWin Sports Betting and N8 Casino. The best part is that both of these platforms offer a crypto bonus of 5% for the tether deposit method!

How to deposit using Tether on N8 Casino

Step 1:

Go to the Accounts page: n8.com/account

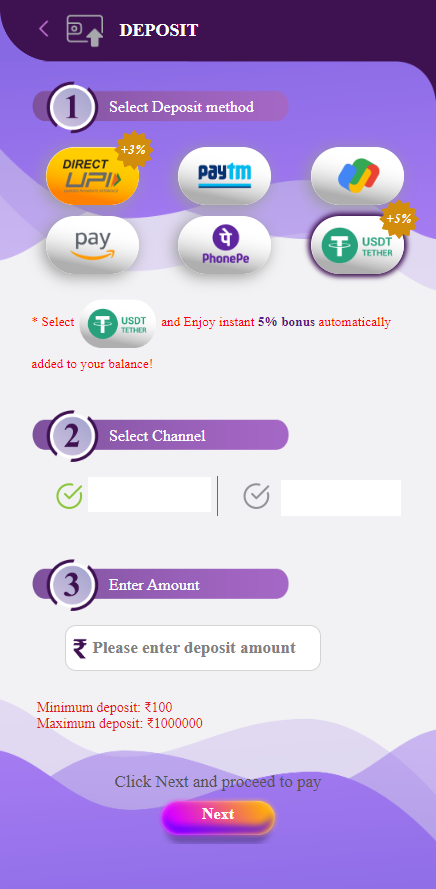

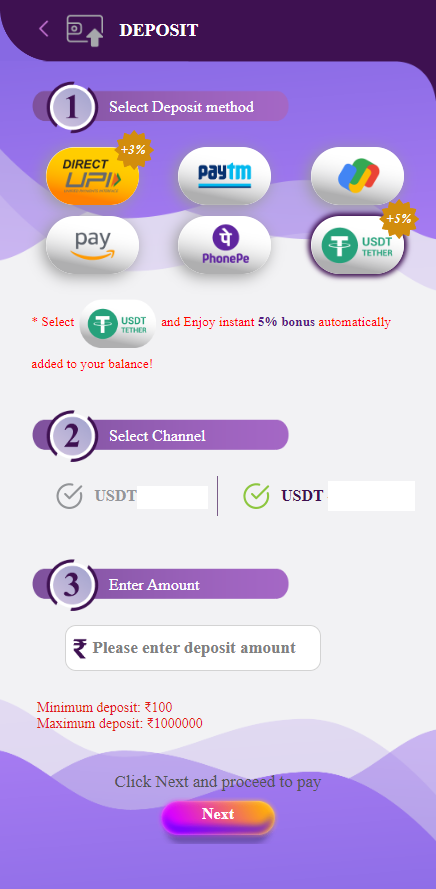

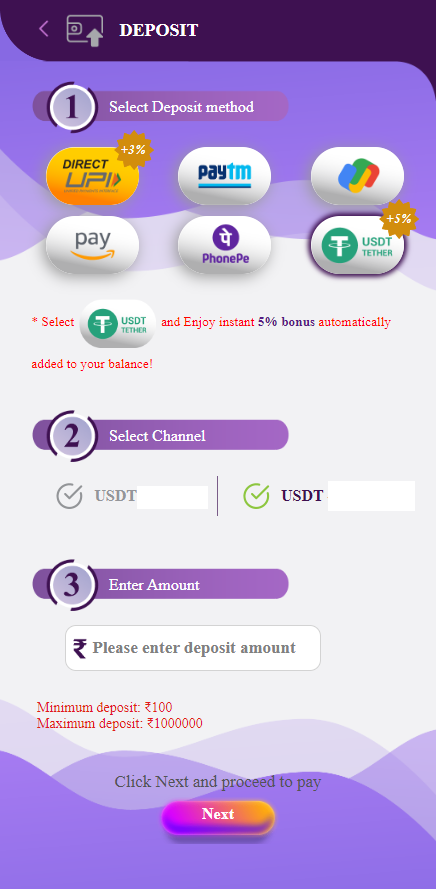

Step 2:

Select the deposit method “USDT Tether” and get the instant 5% bonus

Step 3:

Select the USDT channel

Step 4: Deposit

Enter the Amount and click next.

Step 5: Then you can deposit using scanning the barcode / by using coping the deposit link

Is Tether a worthwhile investment?

The dangers associated with Tether purchases, and cryptocurrency purchases in general, should be thoroughly researched prior to making any purchases. If you’re contemplating a purchase of USDT, take the following into account:

It’s a stablecoin

Tokenized US Dollar (USDT) is a stablecoin. As such, its value is not meant to fluctuate and instead tracks the cost of an underlying asset. Given this, purchasing USDT with the purpose of making a profit is, in principle, equivalent to purchasing the same amount of cash (USD). You should look elsewhere than USDT if you want to speculate on the price of a cryptocurrency.

It’s controversial

According to rumours, Tether Limited, the corporation behind USDT, has strong ties to Bitfinex. Tether Limited has severed ties with auditors who were supposed to confirm that the USDT in circulation is backed by fiat currency reserves, despite the company’s assurances to the contrary. As a result of this episode, doubts and questions have been raised concerning the stability of USDT’s backing by US dollar reserves.

Despite Moore Cayman’s 2021 reports seemingly supporting Tether’s claims that USDT is completely supported by reserves, it is still important to consider other perspectives. One study from the University of Texas at Austin argues that the real goal of Tether is to maintain a high Bitcoin price.

There are other stablecoins pegged to the US dollar besides USDT, thus there is competition. If you’re looking for an alternative to Tether, USDC and Binance USD are two options to examine.

USDT Use case

Since USDT is a stablecoin, capital appreciation is not a necessary motive for buying the currency. Stablecoins provide a hedge against price fluctuations in the cryptocurrency market, making them an attractive investment option for those who want to keep their money digitally. They can also be utilized for DeFi activities like skating and yield farming without too much market risk.